Stellantis N.V. Common Shares (STLA)

7.9000

+0.2800 (3.67%)

NYSE · Last Trade: Feb 12th, 5:24 PM EST

The finding by the Obama administration forms the basis for U.S. actions to reduce greenhouse emissions and fight climate change, including the laws on vehicle tailpipe emissions which have aided the transition to electric vehicles.

Via Stocktwits · February 12, 2026

Record revenue, deep EV losses, and a sharp pivot toward hybrids are reshaping this automaker's profit story, today, Feb. 11, 2026.

Via The Motley Fool · February 11, 2026

Is the SoundHound AI sell-off a red flag or a gift? The fundamentals tell an interesting story.

Via The Motley Fool · February 11, 2026

Stellantis Eyes Exiting Battery JV With Samsung Amid EV Pullback: Reportstocktwits.com

Via Stocktwits · February 10, 2026

Ford held steady as investors looked past day-to-day price moves and toward whether earnings can support a clearer path to improved profitability.

Via The Motley Fool · February 10, 2026

As of February 10, 2026, Ford Motor Company (NYSE: F) stands at a defining crossroads in its 123-year history. After a turbulent 2025 that saw the company navigate significant supply chain disruptions and a massive restructuring of its electric vehicle (EV) ambitions, Ford is currently the primary case study for "legacy" transition in the automotive [...]

Via Finterra · February 10, 2026

The Dow Jones Industrial Average (DJIA) achieved a monumental milestone on Friday, February 6, 2026, closing above the 50,000 mark for the first time in history. The index finished the week at 50,115.67, gaining over 1,200 points in a single session to cap off a historic

Via MarketMinute · February 9, 2026

Dow 50,000: A Milestone for the History Books Amidst an AI Spending Warchartmill.com

Via Chartmill · February 9, 2026

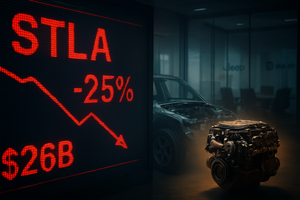

The global automotive landscape was jolted on February 6, 2026, as Stellantis N.V. (NYSE: STLA) saw its shares plummet by 25% following the announcement of a massive €22.2 billion ($26 billion) one-time charge. The staggering write-down is the cornerstone of a radical "business reset" orchestrated by new leadership

Via MarketMinute · February 6, 2026

AMSTERDAM — In a day of unprecedented volatility for the global automotive sector, Stellantis NV (NYSE: STLA) saw its stock price crater by more than 24% on Friday, February 6, 2026. The collapse followed a grim financial disclosure in which the world’s fourth-largest automaker announced a staggering €22.2 billion

Via MarketMinute · February 6, 2026

Investors were surprised by the cost of Stellantis's EV reset, and not in a good way.

Via The Motley Fool · February 6, 2026

These stocks are the most active in today's sessionchartmill.com

Via Chartmill · February 6, 2026

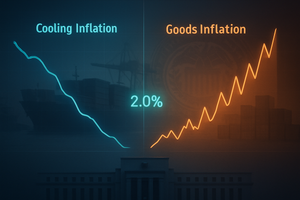

As of February 6, 2026, the American economy finds itself in a precarious balancing act. The "Liberation Day" tariffs, a cornerstone of the current administration’s trade policy, have successfully reshaped supply chains but at a significant cost: "sticky" goods inflation. While services inflation has largely cooled, the persistent rise

Via MarketMinute · February 6, 2026

The latest Personal Consumption Expenditures (PCE) price index data has revealed a significant shift in the U.S. inflationary landscape, presenting a complex puzzle for the Federal Reserve. As of early February 2026, the data shows a stark divergence: while the services sector—the primary engine of post-pandemic inflation—is

Via MarketMinute · February 6, 2026

Get insights into the top gainers and losers of Friday's pre-market session.chartmill.com

Via Chartmill · February 6, 2026

The charges stem from a reset of Stellantis’ EV strategy after the company said it overestimated the pace of electric vehicle adoption.

Via Stocktwits · February 6, 2026

The semiconductor giant plays a central role in the expansion of the AI market.

Via The Motley Fool · February 4, 2026

The announcement, delivered from the East Room alongside the CEOs of the nation's largest industrial titans, marks a fundamental shift in U.S. economic policy. By treating critical minerals with the same strategic gravity as crude oil, the administration intends to provide a "sovereign shock absorber" for domestic manufacturers. For

Via MarketMinute · February 2, 2026

According to a Bloomberg report, the initiative will create a centralized reserve of essential metals and minerals, including rare earths, to help shield companies from volatile global markets influenced by China.

Via Stocktwits · February 2, 2026

The electric vertical takeoff and landing (eVTOL) market offers huge upside potential, but also downside risk.

Via The Motley Fool · January 31, 2026

As the final trading day of January 2026 draws to a close, North American markets are grappling with a renewed surge in trade-related volatility. On January 30, 2026, shares of Bombardier Inc. (TSX: BBD.B) plunged by over 7% following a direct broadside from the White House, marking a sharp

Via MarketMinute · January 30, 2026

Former hedge fund manager Jim Cramer says shares of Amazon and Uber can go even higher.

Via The Motley Fool · January 29, 2026

Apple is a better long-term play than this speculative voice AI stock.

Via The Motley Fool · January 28, 2026

DETROIT — January 28, 2026 — General Motors (NYSE: GM) has once again defied industry skeptics, reporting a resilient fourth-quarter performance that underscores its transition from a volume-focused automaker to a lean, earnings-per-share powerhouse. On the heels of a fiscal year defined by record-breaking internal combustion engine (ICE) sales and a disciplined

Via MarketMinute · January 28, 2026

In a pivotal moment for the American automotive landscape, General Motors (NYSE: GM) released its fourth-quarter and full-year 2025 earnings on January 27, 2026, unveiling what analysts are calling "The Great Recalibration." The Detroit giant delivered a staggering beat on adjusted earnings per share, reporting $2.51 against Wall Street

Via MarketMinute · January 27, 2026