Latest News

Shares of global advertising giant Omnicom Group (NYSE:OMC) jumped 3.9% in the afternoon session after BNP Paribas Exane adjusted its price target on the company to $120 from $115.

Via StockStory · January 14, 2026

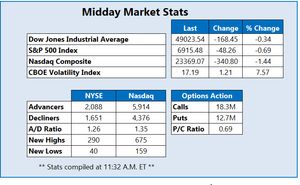

The financial markets experienced a significant downturn on January 14, 2026, as investors grappled with a dense "data dump" following a 43-day federal government shutdown. The simultaneous release of the November 2025 Producer Price Index (PPI) and Retail Sales reports painted a picture of an economy that is simultaneously "too

Via MarketMinute · January 14, 2026

As the global race for semiconductor dominance intensifies, Apple Inc. (NASDAQ: AAPL) has executed a decisive strategic maneuver to consolidate its lead in the mobile and personal computing markets. Recent supply chain reports confirm that Apple has successfully reserved over 50% of the initial 2nm (N2) manufacturing capacity from Taiwan Semiconductor Manufacturing Company (NYSE: TSM [...]

Via TokenRing AI · January 14, 2026

Adobe shares have started the year under heavy selling pressure, breaking key support levels and signaling that a final bearish wave may now be unfolding before a potential long-term base later this year.

Via Talk Markets · January 14, 2026

The semiconductor industry has officially entered the "Glass Age." As of early 2026, the long-standing physical limits of organic packaging materials have finally collided with the insatiable thermal and processing demands of generative AI, sparking a massive industry-wide pivot. Leading the charge are South Korean tech giants Samsung Electro-Mechanics (KRX: 009150) and LG Innotek (KRX: [...]

Via TokenRing AI · January 14, 2026

In a stunning display of economic resilience, U.S. retail sales surged past consensus estimates in the closing months of 2025, effectively cementing a "soft landing" scenario as the calendar turns to 2026. Despite a labor market that has cooled to its slowest hiring pace in over two decades, American

Via MarketMinute · January 14, 2026

Via Benzinga · January 14, 2026

Via Benzinga · January 14, 2026

The United States labor market hit a significant speed bump in the final month of 2025, sending ripples of uncertainty through Wall Street and the hallowed halls of the Federal Reserve. According to the latest data released by the Bureau of Labor Statistics, nonfarm payrolls increased by a meager 50,

Via MarketMinute · January 14, 2026

The global semiconductor race has officially entered a new, smaller, and vastly more expensive chapter. As of January 14, 2026, Intel (NASDAQ: INTC) has announced the successful installation and completion of acceptance testing for its first commercial-grade High-Numerical Aperture (High-NA) Extreme Ultraviolet (EUV) lithography machine. The system, the ASML (NASDAQ: ASML) Twinscan EXE:5200B, represents a [...]

Via TokenRing AI · January 14, 2026

Via Benzinga · January 14, 2026

When silver finally tops and declines, it’s likely to slide profoundly – likely to the $50 - $60 area. What used to be a daring bullish target area is now a distant support.

Via Talk Markets · January 14, 2026

The S&P 500 has kicked off 2026 with a powerful display of momentum, climbing 1.9% in the first two weeks of the year to reach historic levels. Following a robust 16.4% gain in 2025, the index hit a record closing high of 6,977.32 on January

Via MarketMinute · January 14, 2026

The Consumer Electronics Show (CES) 2026 has officially transitioned from a showcase of consumer gadgets to the primary battlefield for the most critical component in the artificial intelligence era: High Bandwidth Memory (HBM). What industry analysts are calling the "HBM4 Memory War" reached a fever pitch this week in Las Vegas, as the world’s leading [...]

Via TokenRing AI · January 14, 2026

Via Benzinga · January 14, 2026

Via MarketBeat · January 14, 2026

As the sun rises on 2026, the frozen tundra of the global capital markets has finally given way to a roaring spring. Following two years of stagnation characterized by "wait-and-see" attitudes and high-interest-rate anxiety, the financial world is witnessing a dramatic resurgence. At the heart of this revival are the

Via MarketMinute · January 14, 2026

AMC Entertainment shares are down on Wednesday as the stock struggles to maintain momentum following recent box office successes.

Via Benzinga · January 14, 2026

The technological landscape shifted decisively at CES 2026 as Intel Corporation (NASDAQ: INTC) officially unveiled its "Panther Lake" processors, branded as the Core Ultra Series 3. This landmark release represents more than just a seasonal hardware update; it is the definitive debut of the Intel 18A (1.8nm) manufacturing process, a node that the company has [...]

Via TokenRing AI · January 14, 2026

Both ETFs and individual stocks are common in the stock market, but they work in different ways and suit different investing goals.

Via Benzinga · January 14, 2026

A fresh wave of political pressure on the Federal Reserve is rippling through financial markets, and cryptocurrencies are among the biggest beneficiaries.

Via Benzinga · January 14, 2026

As the financial markets recalibrate for the 2026 fiscal year, the narrative of the banking sector is dominated by a return to traditional profitability models and a strategic shift in power. On January 14, 2026, the release of fourth-quarter earnings from the nation’s largest lenders has confirmed what many

Via MarketMinute · January 14, 2026

Curious about the most active S&P500 stocks in today's session?chartmill.com

Via Chartmill · January 14, 2026

BARK’s insider-led buyout proposal has exposed a volatile setup, heavy short positioning, thin liquidity, and a stock trading near cycle lows.

Via Barchart.com · January 14, 2026

Meta Reportedly Cuts 1500 People In Reality Labs Divisionstocktwits.com

Via Stocktwits · January 14, 2026

The semiconductor landscape reached a historic milestone this month as Taiwan Semiconductor Manufacturing Company (NYSE: TSM) officially commenced high-volume production of its 2-nanometer (N2) process technology. As of January 14, 2026, the transition represents the most significant architectural overhaul in the company's history, moving away from the long-standing FinFET design to the highly anticipated Gate-All-Around [...]

Via TokenRing AI · January 14, 2026

Nvidia shares are trading lower on Wednesday. The stock may be declining following reports Nvidia's H200 chips are being restricted in China.

Via Benzinga · January 14, 2026

In a landmark financial result that signals the most significant turning point in its decade-long turnaround, Citigroup (NYSE: C) reported fourth-quarter 2025 earnings today that blew past even the most optimistic Wall Street forecasts. While analysts had entered the quarter expecting a sector-leading 21% year-on-year growth, the bank delivered a

Via MarketMinute · January 14, 2026

In a financial performance that has effectively silenced skeptics of the "AI bubble," NVIDIA (NASDAQ: NVDA) reported staggering third-quarter fiscal 2026 results that underscore its total dominance of the generative AI era. The company posted a record-breaking $57 billion in total revenue, representing a 62% year-over-year increase. This surge was almost entirely propelled by its [...]

Via TokenRing AI · January 14, 2026

As the first major financial institution to pull back the curtain on its final performance for 2025, JPMorgan Chase & Co. (NYSE: JPM) has officially kicked off the 2026 earnings season with a report that signals both resilience and transition. On January 13, 2026, the banking giant posted adjusted earnings that

Via MarketMinute · January 14, 2026

Via Benzinga · January 14, 2026

Via Benzinga · January 14, 2026

Curious about the most active stocks on Wednesday?chartmill.com

Via Chartmill · January 14, 2026

This lesson-filled episode makes the case for capital "H" History as an investor's secret weapon -- and for why perspective, patience, and precise thinking continue year after year to help investors crush stock market averages.

Via The Motley Fool · January 14, 2026

Heavy post-earnings fatigue is encapsulating Wall Street this afternoon, as Wells Fargo and Bank of America struggle to brush off disappointing reports.

Via Talk Markets · January 14, 2026

Don't panic. Instead, take these key steps.

Via The Motley Fool · January 14, 2026

The chip stock was trading up for most of the year but fell late in 2025.

Via The Motley Fool · January 14, 2026

When a small-cap stock announces a possible partnership with Nvidia, that's a recipe for big gains.

Via The Motley Fool · January 14, 2026

NVDA stock is back in focus as a projected $3 trillion wave of global data center investment reinforces long-term demand for AI infrastructure.

Via Barchart.com · January 14, 2026

Here's where I have the most money invested right now.

Via The Motley Fool · January 14, 2026

Defense and aerospace industry experienced a volatile week with Trump's proposals, including budget increase of 66%, benefiting US contractors.

Via Benzinga · January 14, 2026

The company is benefiting mightily from its portfolio of weight-loss drugs.

Via The Motley Fool · January 14, 2026

Devon Energy has had unusual call option activity today, according to a Barchart report. Devon announced it will release Q4 earnings on Feb. 17, so investors may be expecting a dividend hike then.

Via Barchart.com · January 14, 2026

Shares of Rivian Automotive moved lower on Wednesday morning after UBS analyst Joseph Spak downgraded the struggling EV maker from

Via Talk Markets · January 14, 2026